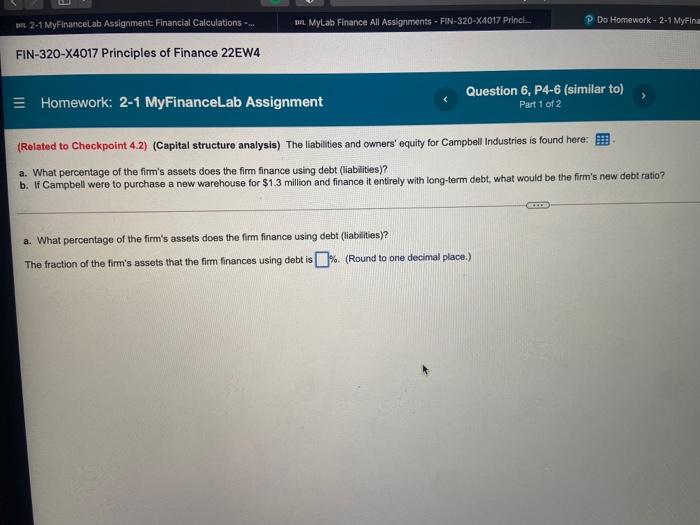

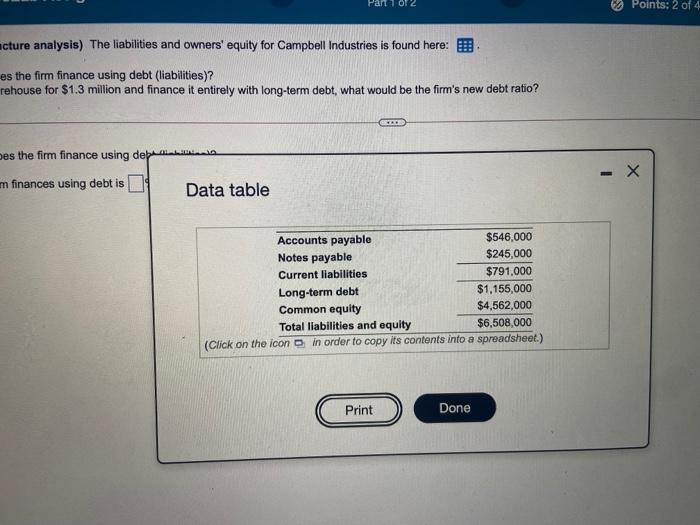

Embark on an extraordinary journey with the FIN 320 3-1 MyFinanceLab assignment, a comprehensive guide to the captivating world of finance. Delve into the intricacies of financial analysis, statement interpretation, and the time value of money, gaining invaluable insights that will empower you to make informed financial decisions throughout your life.

Our exploration will encompass essential concepts such as capital budgeting, risk assessment, and portfolio management, equipping you with the knowledge and skills to navigate the complexities of the financial markets. Whether you aspire to become a financial professional or simply seek to enhance your financial literacy, this assignment will provide a solid foundation for your future success.

1. Course Overview

This course provides an introduction to the fundamental concepts and tools used in financial analysis. It is designed to equip students with the knowledge and skills necessary to understand and analyze financial statements, make informed investment decisions, and manage financial resources effectively.

Upon completion of this course, students will be able to:

- Understand the purpose and objectives of financial analysis.

- Apply various financial analysis tools and techniques to assess a company’s financial health.

- Interpret financial statements and identify key financial ratios and metrics.

- Evaluate capital budgeting projects and make investment decisions.

- Understand the concepts of risk and return and manage investment risk.

- Construct and manage investment portfolios.

li>Calculate the time value of money and apply it to financial decision-making.

2. Financial Analysis Tools

Financial analysis is the process of evaluating a company’s financial performance and position. It involves using various tools and techniques to assess a company’s financial health, profitability, and risk.

Common financial analysis tools include:

- Financial ratios

- Trend analysis

- Common-size analysis

- Vertical analysis

- Horizontal analysis

- DuPont analysis

3. Financial Statement Analysis

Financial statements are the primary source of information for financial analysis. They provide a snapshot of a company’s financial performance and position at a specific point in time.

The three main types of financial statements are:

- Income statement

- Balance sheet

- Cash flow statement

Financial statement analysis involves using various techniques to assess a company’s profitability, liquidity, solvency, and overall financial health.

4. Time Value of Money: Fin 320 3-1 Myfinancelab Assignment

The time value of money (TVM) is the concept that money today is worth more than money in the future due to its potential earning power.

The TVM is used in a variety of financial applications, including:

- Calculating the present value of future cash flows

- Determining the future value of present investments

- Evaluating the profitability of investment projects

5. Capital Budgeting

Capital budgeting is the process of evaluating and selecting long-term investment projects. It involves estimating the cash flows associated with a project and using various techniques to determine its profitability and risk.

Common capital budgeting techniques include:

- Net present value (NPV)

- Internal rate of return (IRR)

- Payback period

- Profitability index

6. Risk and Return

Risk and return are two key concepts in finance. Risk refers to the uncertainty of an investment’s future performance, while return refers to the potential gain or loss from an investment.

There is a positive relationship between risk and return. In general, the higher the risk of an investment, the higher the potential return.

Common types of investment risk include:

- Market risk

- Interest rate risk

- Inflation risk

- Currency risk

- Political risk

7. Portfolio Management

Portfolio management is the process of selecting and managing a group of investments to meet specific investment objectives.

The goal of portfolio management is to maximize return while minimizing risk.

Common types of investment portfolios include:

- Stock portfolios

- Bond portfolios

- Mutual funds

- Exchange-traded funds (ETFs)

FAQ

What is the purpose of the FIN 320 3-1 MyFinanceLab assignment?

This assignment is designed to provide students with a comprehensive understanding of financial concepts and their practical applications in the real world.

What topics are covered in this assignment?

The assignment covers a wide range of topics, including financial analysis, statement interpretation, time value of money, capital budgeting, risk assessment, and portfolio management.

How can I benefit from completing this assignment?

Completing this assignment will enhance your financial literacy, equip you with essential investment strategies, and provide a solid foundation for your future financial success.