Businesses formed trusts pools and holding companies mainly to achieve specific business objectives, such as asset protection, tax minimization, and liability management. These structures offer unique advantages and legal implications that businesses must carefully consider when making decisions about their organizational structure.

In this comprehensive guide, we will explore the concept of trusts, pools, and holding companies, examining their legal and financial implications. We will provide examples of businesses that have successfully utilized these structures to achieve their goals, and discuss the advantages and disadvantages of each option.

Trusts and Pools: Businesses Formed Trusts Pools And Holding Companies Mainly To

Trusts and pools are legal arrangements that involve the transfer of assets to a third party, known as a trustee or pool manager, who holds and manages the assets for the benefit of designated beneficiaries or pool participants.

Trusts are typically used for asset protection, estate planning, and tax minimization, while pools are commonly used for collective investment and risk management.

Advantages of Trusts and Pools

- Asset protection from creditors and lawsuits

- Tax minimization through income splitting and deferral

- Estate planning and wealth preservation

- Risk pooling and diversification of investments

Disadvantages of Trusts and Pools

- Potential loss of control over assets

- Administrative and legal costs

- Tax implications for certain types of trusts

- Potential for conflicts of interest between trustees/pool managers and beneficiaries/participants

- Centralized control and management of multiple businesses

- Tax optimization through inter-company transactions

- Protection of assets from subsidiaries’ liabilities

- Easier access to capital and financing

- Increased administrative and compliance costs

- Potential for double taxation

- Reduced flexibility and agility due to multiple layers of management

- Regulatory scrutiny and potential liabilities

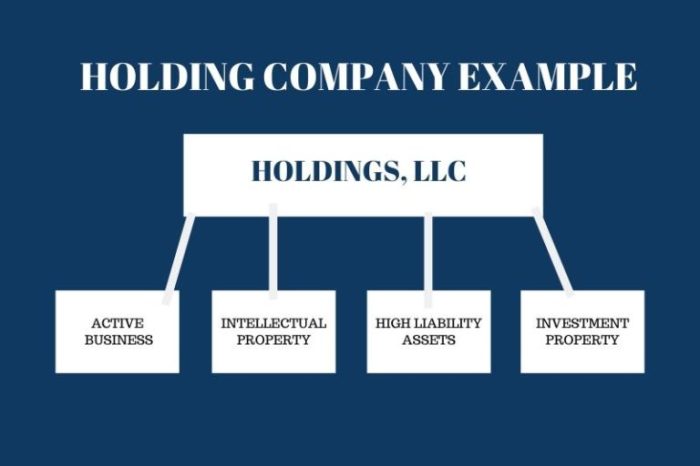

Holding Companies

A holding company is a company that owns controlling interests in one or more other companies, known as subsidiaries. Holding companies do not typically engage in direct business operations, but rather serve as a parent company that provides strategic guidance and financial support to its subsidiaries.

Advantages of Holding Companies

Disadvantages of Holding Companies

Business Objectives

Businesses form trusts, pools, and holding companies to achieve a variety of business objectives, including:

Asset Protection

Trusts and holding companies can be used to protect assets from creditors, lawsuits, and other financial risks.

Tax Minimization

Trusts and holding companies can be structured to minimize tax liability through income splitting, deferral, and other tax planning strategies.

Liability Management

Holding companies can isolate liabilities within subsidiaries, protecting the parent company and other subsidiaries from potential legal claims.

Legal and Regulatory Implications

The formation and operation of trusts, pools, and holding companies are subject to various legal and regulatory requirements:

Trusts

Trusts must comply with trust laws, including rules governing the creation, administration, and termination of trusts.

Pools

Pools must comply with securities laws and regulations governing collective investment vehicles.

Holding Companies, Businesses formed trusts pools and holding companies mainly to

Holding companies must comply with corporate laws and regulations, including reporting requirements and potential liabilities for the actions of their subsidiaries.

Alternative Business Structures

Trusts, pools, and holding companies are not the only business structures available. Other options include:

Partnerships

Partnerships are business structures where two or more individuals or entities share ownership and management responsibilities.

Limited Liability Companies (LLCs)

LLCs are hybrid business structures that combine the flexibility of partnerships with the liability protection of corporations.

Comparison of Business Structures

| Characteristic | Trusts | Pools | Holding Companies | Partnerships | LLCs |

|---|---|---|---|---|---|

| Liability Protection | Yes | Yes (for participants) | Yes | No | Yes |

| Taxation | Varies depending on trust type | Varies depending on pool structure | Potentially complex | Pass-through | Pass-through |

| Flexibility | Limited | Limited | Moderate | High | High |

Top FAQs

What are the primary reasons why businesses form trusts, pools, and holding companies?

Businesses form these structures primarily to achieve specific objectives, such as asset protection, tax minimization, and liability management.

What are the key advantages of forming a trust?

Trusts offer advantages such as asset protection, privacy, and estate planning benefits.

What are the legal considerations associated with forming a holding company?

Forming a holding company involves legal considerations such as regulatory compliance, reporting requirements, and potential liabilities.